It is not often that we talk about Jean-Claude Trichet – the inimitable and outgoing European Central Bank president here, but last week he said something rather interesting at a London School of Economics event which deserves a mention in light of the unfolding Greek tragedy (part II) and before we talk crude pricing.

Trichet said the ECB needs to ensure that oil (and commodity) price increases witnessed in recent months do not trigger inflationary problems. Greece aside, Trichet opined that the Euro zone recovery was on a good footing even though unemployment (currently at a ten year high) was “far too high.”

While he did not directly refer to the deterioration in Greece’s fiscal situation, it may yet have massive implications for the Euro zone. Its impact on crude prices will be one of confidence, rather than one of consumption pattern metrics. Greece, relative to other European players, is neither a major economy and nor a major crude consuming nation. Market therefore will be factoring in the knock-on effect were it to default.

Quite frankly, the Oilholic agrees with Fitch Ratings that if commercial lenders roll over their loans to Greece, it will deem the country to be in “default". Standard & Poor's has already issued a similar warning while Moody’s says there is a 50% chance of Greece missing a repayment within three to five years.

With confidence not all that high and the OPEC meeting shenanigans from a fortnight now consigned to the history books, the crude price took a dip with the ICE Brent forward month futures contract at US$112.54 last time I checked. Nonetheless, oil market fundamentals for the rest of 2010 and 2011 are forecasted to be reasonably bullish.

Analysts at Société Générale feel many of the prevalent downside risks are non-fundamental. These include macro concerns about the US, Europe (as noted above) and China; the end of QE2 liquidity injections; concerns about demand destruction; uncertainty about Saudi price targets; fading fears of further MENA supply disruptions; and still-high levels of non-commercial net length in the oil markets.

In an investment note to clients, Mike Wittner, the French investment bank’s veteran oil market analyst wrote: “Based on these offsetting factors, our forecast for ICE Brent crude is neutral compared to current prices. We forecast Brent at US$114 in Q3 11 (upward revision of $3) and US$113 in Q4 11 (+$6). Our forecast for 2012 is for Brent at US$115 (+$5). Compared to the forward curve, we are neutral for the rest of 2011 and slightly bullish for 2012.”

Meanwhile the IEA noted that a Saudi push to replace “lost” Libyan barrels would need to be competitively priced to bring relief. Market conjecture and vibes from Riyadh suggest that while the Saudis may well wish to up production and cool the crude price, they are not trying to drive prices sharply lower.

The problem is a “sweet” one. The oil market for the rest of 2011, in the agency’s opinion, looks potentially short of sweet crude, should the Libyan crisis continue to keep those supplies restrained. Only “competitively priced OPEC barrels” whatever the source might be could bring welcome relief, it concludes.

Now on to corporate matters, the most geopolitically notable one among them is a deal signed by ConocoPhillips last Thursday, with the government of Bangladesh to explore parts of the Bay of Bengal for oil and gas. This is further proof, if one needed any, that the oil majors are venturing beyond the traditional prospection zones and those considered “non-traditional” thus far aren’t any longer.

The two zones, mentioned in the deal, are about 175 miles offshore from the Bangladeshi port of Chittagong at a depth of 5,000 feet covering an area of approximately 1.27 million acres. According to a ConocoPhillips' corporate announcement exploration efforts will begin “as soon as possible.”

In other matters, the man who founded Cairn Energy in 1980 – Sir Bill Gammell is to step down as the independent oil upstart’s chief executive to become its non-executive chairman under a board reshuffle. He will replace current chairman Norman Murray, while the company’s legal and commercial director Simon Thomson will take over the role of chief executive.

However, Sir Bill would continue as chairman of Cairn India and retain responsibility for the sale of Cairn Energy's Indian assets to Vedanta in a deal worth nearly US$10 billion. The deal has been awaiting clearance for the last 10 months from the Indian government which owns most of ONGC, which in turn has a 30% stake in Cairn India's major oil field in Rajasthan.

It was agreed in 1995, that ONGC would pay all the royalties on any finds in the desert. But that was before oil had been found and the government is now trying to change the terms of that arrangement with some typical Indian-style bickering.

Elsewhere, after becoming a publicly-listed company last month, Glencore – the world's largest commodities trader – reported a net profit for the first three months of the year to the tune of US$1.3 billion up 47% on an annualised basis. Concurrently, in its first public results, the trader said revenue was up 39% to US$44.2 billion.

Glencore's directors and employees still hold about 80% of the company and the figures should make them happier and wealthier still. Glencore leads the trading stakes with Vitol and Gennady Timchenko’s Gunvor second and third respectively.

Finally, the so-called most hated man in America – Tony Hayward – commenced a rather spectacular comeback last week flanked by some influential friends. Together with financier Nathaniel Rothschild, investors Tom Daniel and Julian Metherel, Hayward has floated Vallares, an oil and gas investment vehicle which raised £1.35 billion (US$2.18 billion) through an IPO recently.

This is well above market expectations according to most in the City and all four have nailed their colours to the mast by putting in £100 million of their own money. Some 133 million ordinary shares nominated at £10 each were offered and taken-up rather enthusiastically. Rumour has it that hedge funds, selected Middle Eastern sovereign wealth funds and institutional investors (favouring long-only positions) are among the major buyers.

Vallares’ focus will be on upstream oil and gas assets away from "tired, second-hand assets" in the North Sea or in politically unstable areas such as Venezuela or central Asia. The Oilholic thinks this is way more than an act of hubris. However, the investment vehicle’s success will not particularly reverse Hayward’s deeply stained reputation. A failure well be the end. Only time will tell but the front man has brought some powerful friends along on the “comeback” trail. They are likely to keep a more watchful eye over Hayward and perhaps prevent him from going wayward.

© Gaurav Sharma 2011. Photo: Fairfax, Virginia, USA © O. Louis Mazzatenta, National Geographic

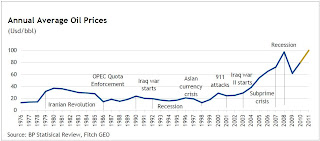

It has been a month of quite a few interesting reports and comments, but first and as usual - a word on pricing. Both Brent crude oil and WTI futures have partially retreated from the highs seen last month, especially in case of the latter. That’s despite the Libyan situation showing no signs of a resolution and its oil minister Shukri Ghanem either having defected or running a secret mission for Col. Gaddafi depending on which news source you rely on! (Graph 1: Historical average annual oil prices. Click on graph to enlarge.)

It has been a month of quite a few interesting reports and comments, but first and as usual - a word on pricing. Both Brent crude oil and WTI futures have partially retreated from the highs seen last month, especially in case of the latter. That’s despite the Libyan situation showing no signs of a resolution and its oil minister Shukri Ghanem either having defected or running a secret mission for Col. Gaddafi depending on which news source you rely on! (Graph 1: Historical average annual oil prices. Click on graph to enlarge.)