US secretary of state Hillary Clinton has been clocking up air miles trying to persuade India and China to import less of the crude stuff from Iran. While diplomatic issues dominated the headlines during her visit, Clinton is understood to have impressed upon the Chinese to lower Iranian imports. However, recent media reports suggest that instead of seeking alternative supplies away from Iran, the economic powerhouse is seeking alternative modes of payment to Tehran away from the US Dollar. First, Reuters cited Mohammed Reza Fayyad, Iran's ambassador to the United Arab Emirates, acknowledging that his country was accepting Yuan payments in kind for oil exports to China. Then the FT reported that China has been providing the Yuan to Iran via Russian banks rather than its own international banks.

US secretary of state Hillary Clinton has been clocking up air miles trying to persuade India and China to import less of the crude stuff from Iran. While diplomatic issues dominated the headlines during her visit, Clinton is understood to have impressed upon the Chinese to lower Iranian imports. However, recent media reports suggest that instead of seeking alternative supplies away from Iran, the economic powerhouse is seeking alternative modes of payment to Tehran away from the US Dollar. First, Reuters cited Mohammed Reza Fayyad, Iran's ambassador to the United Arab Emirates, acknowledging that his country was accepting Yuan payments in kind for oil exports to China. Then the FT reported that China has been providing the Yuan to Iran via Russian banks rather than its own international banks.Arriving next in India, Clinton had a similar message for New Delhi. She “commended” India for lowering its reliance on Iranian imports urging it to do more. However, as the Oilholic noted on his non-state visit to India earlier this year - Indian policymakers openly admit this is easier said than done. Meanwhile conspiracy theories about the death on April 29 of former Libyan Oil Minister Shokri Ghanem, whose body was found in the River Danube in Vienna, are unlikely to go away with his funeral held four days ago.

In June 2011, his defection from the Gaddafi regime was the epicentre of media gossip – both in the run-up to the 159th OPEC meeting as well as during the event itself where his defection relieved some and riled others. Some doubted his intentions while others doubted that he’d even defected.

All in public domain was that since his defection he had been living in Vienna with his family and working as a consultant. It seemed to be a natural choice since Ghanem’s connection with the city went back a few decades. He had held a number of posts at the old OPEC HQ in Vienna rising to its head of research in 1993 before joining the Gaddafi government first as Prime Minister and then Oil minister which marked his regular return to Vienna until last year.

The Oilholic’s sources in Vienna suggest the Austrian authorities have ruled out foul play. All yours truly knows is that a passer-by saw his body in the river and called the police who found no other documents on him other than business cards of his consultancy. There were no signs of violence on the body and it is thought that he died of natural causes. At the time of his death, he was setting up a business with another OPEC veteran - Algeria's Chakib Khelil and other investors.

However back home, the new government in Tripoli never trusted him despite his defection and was in fact preparing a court case against him for making illegal gains during his time in the Gaddafi regime. Regardless of its circumstances, the void left by his death would be felt in Viennese diplomatic circles and at OPEC HQ where he began his career in earnest.

Going back to 2008, the Oilholic remembers his first interaction with Ghanem from press scrums at a meeting of ministers where journalists jostled to receive his answers in fluent English. His audience in Vienna had grown, more so as his boss Gaddafi had denounced terrorism and come back from the cold to rejoin the international community. Whether Ghanem himself was a saint or a sinner will now never be known.

Away from crude politics, troubled refiner Petroplus’ administrators have found a buyer for its Swiss asset – the Cressier Refinery – in the shape of Varo Holding, a joint venture between trading firm Vitol and AltasInvest. Under the sale agreement, cash strapped Petroplus would transfer Cressier and allied Swiss marketing and logistics assets - Petroplus Tankstorage, Oléoduc du Jura Neuchâtelois and Société Française du Pipeline du Jura to Varo.

Sources suggest Varo hopes to close the deal before the end of June with plans of restarting the 68,000 barrels per day refining facility thereafter. Finally, fresh economic headwinds are bringing about a price correction in the crude markets as recent elections in Greece and France have triggered a Greek Tragedy (Part II) and a Geek Tragedy (a.k.a. Francois Hollande) respectively.

A hung parliament and political stalemate with fears of the terms of the last Greek bailout not being met is impacting market sentiment on the one hand. On the other, newly elected Socialist President of France – Francois Hollande – sees his less than convincing mandate as one of the French public voting against ‘austerity’ and perhaps uncosted grandiose spending plans. On Tuesday, oil trading sessions either side of the pond remained volatile in light of the situation.

Summing up the nerviness in the markets following events of the past few days, Sucden Financial analyst Myrto Sokou notes, “Spain has confirmed that it will provide with additional money for the bank rescue of Bankia, the country's third largest bank in terms of assets. In Greece, the political situation is still uncertain as the country remains without a government after Sunday’s elections…The parties which signed the EU bailout memorandum are now in a minority as Greek voters rejected further austerity plans.”

Concurrently, analysts at Société Générale believe that generally bearish sentiments and still weak fundamentals should continue to combine and prevail and that the entire energy complex seems to be headed for a continued correction downwards. “Oil has performed better than other European energy commodities in 2012, but this seems to have changed during the first week of May. Oil price behaviour will be the key to avoid further slides in European energy prices,” they note.

As if that was not crude enough, an investment note by Citibank just hitting the wires suggests there is now a 75% possibility that Greece would be forced to leave the Eurozone within 12 to 18 months. With no swift Eurozone solution in sight, be prepared to expect further volatility and perceptively bearing trends in the crude markets. That’s all for the moment folks! Keep reading, keep it ‘crude’!

© Gaurav Sharma 2012. Photo: Oil Rig © Cairn Energy Plc.

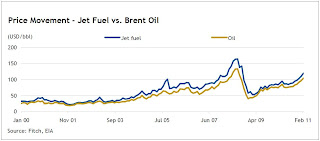

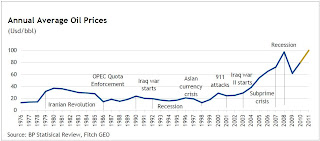

It has been a month of quite a few interesting reports and comments, but first and as usual - a word on pricing. Both Brent crude oil and WTI futures have partially retreated from the highs seen last month, especially in case of the latter. That’s despite the Libyan situation showing no signs of a resolution and its oil minister Shukri Ghanem either having defected or running a secret mission for Col. Gaddafi depending on which news source you rely on! (Graph 1: Historical average annual oil prices. Click on graph to enlarge.)

It has been a month of quite a few interesting reports and comments, but first and as usual - a word on pricing. Both Brent crude oil and WTI futures have partially retreated from the highs seen last month, especially in case of the latter. That’s despite the Libyan situation showing no signs of a resolution and its oil minister Shukri Ghanem either having defected or running a secret mission for Col. Gaddafi depending on which news source you rely on! (Graph 1: Historical average annual oil prices. Click on graph to enlarge.)