.jpg)

There was only story in London town last week, when late in the day on May 14, European Commission (EC) regulators swooped down on the offices of major oil companies having R&M operations in the UK, investigating fuel price fixing allegations. While the EC did not name names, BP, Shell and Statoil confirmed their offices had been among those ‘visited’ by the officials.

More details emerged overnight, as pricing information provider Platts admitted it was also paid a visit. The EC said the investigation relates to the pricing of oil, refined products and biofuels. As part of its probe, it will be examining whether the companies may have prevented others from participating in the pricing process in order to "distort" published prices.

That process, according to sources, is none other than

Platts’ Market On Close (MOC) price assessment mechanism. "Any such behaviour, if established, may amount to violations of European antitrust rules that prohibit cartels and restrictive business practices and abuses of a dominant market position," the EC said, but clarified in the same breath that the raids itself did not imply any guilt on part of the companies.

The probe extends to alleged trading malpractices dating back almost over 10 years. All oil companies concerned, at least the ones who admitted to have been visited by EC regulators, said they were cooperating with the authorities. Platts issued a similar statement reiterating its cooperation.

"I have been raising the issue of alleged fuel price fixing time and again in the House of Commons. With the EC raids, I'd say the OFT has been caught cold and simply needs to look at this again. The issue has cross-party support in the UK," he said.

In wake of the raids, the OFT merely said that it stood by its original investigation and was

assisting the EC in its investigations. Question is, if, and it’s a big if, any wrongdoing is established, then what would the penalties be like and how would they be enforced? Parallels could be drawn between the Libor rate rigging scandal and the fines that followed imposed by US, UK and European authorities. The largest fine (to date) has been CHF1.4 billion (US$1.44 billion) awarded against UBS.

So assuming that wrongdoing is established, and fines are of a similar nature, Fitch Ratings reckons the companies involved could cope. "These producers typically have between US$10 billion and US$20 billion of cash on their balance sheets. Significantly bigger fines would still be manageable, as shown by BP's ability to cope with the cost of the Macondo oil spill, but would be more likely to have an impact on ratings," said Jeffrey Woodruff, Senior Director (Corporates) at Fitch Ratings.

Other than fines, if an oil company is found to have distorted prices, it could face longer-term risks from damage to its reputation. While these risks are less easy to predict and would depend on the extent of any wrongdoing, scope does exist for commercial damage, even for sectors with polarising positions in the public mind, according to Fitch. Given we are in the 'early days' phase, let's see what happens or rather doesn't.

While the EC was busy raiding oil companies, the IEA was telling the world how the US shale bonanza was sending ripples through the oil industry. In its

Medium-Term Oil Market Report (MTOMR), it noted:

"the effects of continued growth in North American supply – led by US light, tight oil (LTO) and Canadian oil sands – will cascade through the global oil market."

While geopolitical risks persist, according to the IEA, market fundamentals were indicative of a more comfortable global oil supply/demand scenario over the next five years at the very least. The MTOMR projected North American supply to grow by 3.9 million barrels per day (mbpd) from 2012 to 2018, or nearly two-thirds of total forecast non-OPEC supply growth of 6 mbpd.

World liquid production capacity is expected to grow by 8.4 mbpd – significantly faster than demand – which is projected to expand by 6.9 mbpd. Global refining capacity will post even steeper growth, surging by 9.5 mbpd, led by China and the Middle East. According to the IEA, having helped offset record supply disruptions in 2012, North American supply is expected to continue to compensate for declines and delays elsewhere, but only if necessary infrastructure is put in place. Failing that, bottlenecks could pressure prices lower and slow development.

Meanwhile, OPEC oil will remain a key part of the oil mix but its production capacity growth will be adversely affected by "growing insecurity in North and Sub-Saharan Africa", the agency said. OPEC capacity is expected to gain 1.75 mbpd to 36.75 mbpd, about 750,000 bpd less than forecast in the 2012 MTOMR. Iraq, Saudi Arabia and the UAE will lead the growth, but OPEC's lower-than-expected aggregate additions to global capacity will boost the relative share of North America, the agency said.

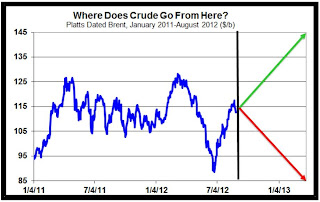

Away from supply-demand scenarios and on to pricing, Morgan Stanley forecasts Brent's premium to the WTI narrow further while progress continues to be made in clearing a supply glut at the US benchamark’s delivery point of Cushing, Oklahoma, over the coming months. It was

above the US$8 mark when the Oilholic last checked, well down on the $20 it averaged for much of 2012.However, analysts at the investment bank do attach a caveat.

Have you heard of the Houston glut? There is no disguising the fact that Houston has been the recipient of the vast majority of the "new" inland crude oil supplies in the Gulf Coast [no prizes for guessing where that is coming from]. The state's extraction processes have become ever more efficient accompanied by its own oil boom to complement the existing E&P activity.

Lest we forget, North Dakota has overtaken every other US oil producing state in terms of its oil output, but not the great state of Texas. Yet, infrastructural limitations persist when it comes to dispatching the crude eastwards from Texas to the refineries in Louisiana.

So Morgan Stanley analysts note: "A growing glut of crude in Houston suggests WTI-Brent is near a trough and should widen again [at least marginally] later this year. Houston lacks a benchmark, but physical traders indicate that Houston is already pricing about $4 per barrel under Brent, given physical limitations in moving crude out of the area."

The Oilholic can confirm that anecdotal evidence does seem to indicate this is the case. So it would be fair to say that Morgan Staley is bang-on in its assessment that the "Houston regional pricing" would only erode further as more crude reaches the area, adding that any move in Brent-WTI towards $6-7 a barrel [from the current $8-plus] should prove unsustainable.

Capacity to bring incremental crude to St. James refineries in Louisiana is limited, so the Louisiana Light Sweet (LLS) will continue to trade well above Houston pricing; a trend that is likely to continue even after the reversal of the Houston-Houma pipeline – the main crude artery between the Houston physical market and St. James.

On a closing note, it seems the 'Bloomberg Snoopgate' affair escalated last week with the Bank of England joining the chorus of indignation. It all began earlier this month when news emerged of Bloomberg's practice of giving its reporters "limited" access to some data considered proprietary, including when a customer looked into broad categories such as equities or bonds.

The scoop – first reported by the

FT – led to a full apology by Matthew Winkler, Editor-in-chief of Bloomberg News, for allowing journalists "limited" access to sensitive data about how clients used its terminals, saying it was "inexcusable". However, Winkler insisted that important and confidential customer data had been protected. Problem is, they aren't just any customers – they include the leading central banks in the OECD.

The US Federal Reserve, the European Central Bank and the Bank of Japan have all said they were examining the use of data by Bloomberg. However, the language used by the Bank of England is the sternest so far. The British central bank described the events at Bloomberg as "reprehensible."

A spokesperson said, "The protection of confidential information is vital here at the bank. What seems to have happened at Bloomberg is reprehensible. Bank officials are in close contact with Bloomberg…We will also be liaising with other central banks on this matter."

In these past few days there have been signs that 'Bloomberg Snoopgate' is growing bigger as Brazil’s central bank and the Hong Kong Monetary Authority (the Chinese territory's de facto central bank) have also expressed their indignation. Having been a Bank of England and UK Office for National Statistics (ONS) correspondent, yours truly can personally testify how seriously central banks take issue with such things and so they should.

Yet, in describing Bloomberg's practice as "reprehensible", the Bank of England has indicated how serious it thinks the breach of confidence was and how miffed it is. The UK central bank has since received assurances from Bloomberg that there would be no repeat of the issue! You bet! That's all for the moment folks! Keep reading, keep it 'crude'!

© Gaurav Sharma 2013. Photo: Abandoned gas station © Todd Gipstein / National Geographic

There should be no shock or horror – it was coming. Ahead of taking a decision on its production quota, president of the 164th OPEC conference Mustafa Jassim Mohammad Al-Shamali, who is also the deputy prime minister and minister of oil of Kuwait, openly acknowledged the uptick in US oil production here in Vienna.

There should be no shock or horror – it was coming. Ahead of taking a decision on its production quota, president of the 164th OPEC conference Mustafa Jassim Mohammad Al-Shamali, who is also the deputy prime minister and minister of oil of Kuwait, openly acknowledged the uptick in US oil production here in Vienna.

.jpg)

.jpg)

.JPG)

.jpg)