The Oilholic returned overnight from a visit to Fujairah, United Arab Emirates, for the 9th Gulf Intelligence Energy Markets Forum; the burgeoning shipping and storage port's annual gathering of industry minds.

And on everyone's mind - unsurprisingly - was the direction of the oil price. This blogger has maintained the market is stuck in the modest middle, given that even 58% of Saudi capacity being temporarily knocked offline last month was not enough to keep Brent futures above $70 per barrel for a sustained period of time.

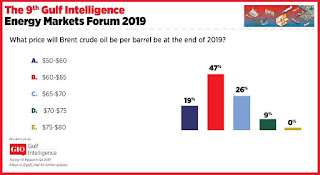

Demand concerns have returned with a vengeance to temper risk driven upticks. The Oilholic remains in the $65 per barrel Brent average bracket. But majority of the delegates to the Forum were even more bearish for the quarter, based on the findings of an instant poll conducted at Gulf Intelligence's behest by yours truly (see image top left, click to enlarge). Many are bracing for a Q4 2019 Brent price in the range of $60-$65 per barrel.

As part of the proceedings, one also got a chance to interview Mele Kyari, Group Managing Director of the Nigerian National Petroleum Corporation (NNPC), both to discuss the spot poll's findings, as well as how Nigeria views the current market dynamic.

Kyari stressed that Nigeria expects global demand to continue at pace driven by petrochemicals and aviation fuel. Tied into that is of course NNPC's own, and much-needed push to both invest, as well as court investment in its downstream sector.

And away from the main auditorium, were several informative industry roundtables. Fujairah itself is undergoing significant changes in light of current geopolitics, inward investment, and the likes of ADNOC and Saudi Aramco mulling trading and storage outposts there. Will be penning thoughts on that subject for Forbes and Rigzone shortly, but that's all from Fujairah for the moment folks. Keep reading, keep it 'crude'!

Addendum I - 06.10.19: Thoughts via Forbes - ADNOC Gets Serious About Its Oil Exports Bypassing Strait Of Hormuz Via Fujairah, here.

Addendum II - 07.10.19: And via Rigzone - Oil Hub of Fujairah Thriving Amid Rising Geopolitical Risk, here.

To follow The Oilholic on Twitter click here.

To follow The Oilholic on Forbes click here.

To email: gaurav.sharma@oilholicssynonymous.com

© Gaurav Sharma 2019. Chart 1: Findings of oil price direction survey at Energy Markets Forum in Fujairah, Oct 1, 2019 © Gulf Intelligence. Photos 1 & 2: Gaurav Sharma interviews Mele Kyari, Group Managing Director of the Nigerian National Petroleum Corporation (NNPC) © Photo 1 - Samantha Morris, © Photo 2 - Gulf Intelligence, October 1, 2019.