BP’s recent settlement with the US authorities does not end the company's legal woes related to the

Gulf of Mexico oil spill, but it is a vital step in the direction of bringing financial closure to the accident.

When the oil major announced on July 2, that it had reached agreements in principle to settle all federal and state claims arising from the

oil spill at a cost of up to $18.7 billion spread over 18 years, markets largely welcomed the move. On a day when the crude oil futures market was in reverse, BP’s share price rose by 4.69% by the close of trading in London, contrary to prevailing trading sentiment, as investors absorbed the welcome news.

Above anything else, the agreement provides certainty about major aspects of BP's financial exposure in wake of the oil spill. As per the deal, BP’s US Upstream subsidiary – BP Exploration and Production (BPXP) – has executed agreements with the federal government and five Gulf Coast States of Alabama, Florida, Louisiana, Mississippi and Texas. Under the said terms, BPXP will pay the US government a civil penalty of $5.5 billion over 15 years under the country’s Clean Water Act.

It will also pay $7.1 billion to the US and the five Gulf states over 15 years for natural resource damages (NRD), in addition to the $1 billion already committed for early restoration. BPXP will also set aside an additional $232 million to be added to the NRD interest payment at the end of the payment period to cover any further natural resource damages that are unknown at the time of the agreement.

A total of $4.9 billion will be paid over 18 years to settle economic and other claims made by the five Gulf Coast states, while up to $1 billion will be paid to resolve claims made by more than 400 local government entities. Finally, what many thought was going to be a prolonged tussle with US authorities might be coming to an end via payments, huge for some and not large enough for others, spread over a substantially long time frame.

BP’s chief executive Bob Dudley described the settlement as a “realistic outcome” which provides clarity and certainty for all parties. “For BP, this agreement will resolve the largest liabilities remaining from the tragic accident and enable the company to focus on safely delivering the energy the world needs.”

The impact of the settlement on the company’s balance sheet and cashflow will be “manageable” and allow it to continue to invest in and grow its business, said chief financial officer Brian Gilvary. As individual and business claims continue, BP said the expected impact of these agreements would be to increase the cumulative pre-tax charge associated with the spill by around $10 billion from $43.8 billion already allocated at the end of the first quarter.

While the settlement is still awaiting court approval, credit ratings agencies largely welcomed the move, alongside many City brokers whose notes to clients were seen by the Oilholic. Fitch Ratings said the deal will considerably strengthen BP’s credit profile, which had factored in “the potential for a larger settlement that took much longer to agree”.

Should the agreement be finalised on the same terms, it is likely to result in positive rating action from the agency. Fitch currently rates BP 'A' with a ‘Negative Outlook.’

Alex Griffiths, Managing Director, Fitch Ratings, said: “While BP had amassed ample liquidity to deal with most realistic scenarios, the scale and uncertain timing of the payment of outstanding fines and penalties remained a key driver of BP's financial profile in our modelling, and had the potential to place a large financial burden on the company amid an oil price slump.

“The certainty the deal provides, and the deferral of the payments over a long period, gives BP the opportunity to improve its balance sheet profile and navigate the current downturn.”

Meanwhile, Moody's has already changed to ‘positive’ from ‘negative’ the outlook on A2 long-term debt and Prime-1 commercial paper ratings of BP and its guaranteed subsidiaries. In wake of the settlement, the ratings agency also changed to ‘positive’ from ‘negative’, its outlook on the A3 and Baa1 Issuer Ratings of BP Finance and BP Corporation North America, respectively.

Tom Coleman, a Moody's Senior Vice President, said: “While the settlement is large, we view the scope and extended payout terms as important and positive developments for BP, allowing it to move forward with a lot more certainty around the size and cash flow burden of its legal liabilities.

“It will also help clarify a stronger core operating and credit profile for BP as it moves into a post-Macondo era.”

The end is not within sight just yet, but some semblance of it is likely to attract new investors. BP's second quarter results are due on July 28, and quite a few eyes, including this blogger’s, will be on the company for clues about the future direction. But that’s all for the moment folks! Keep reading, keep it ‘crude’!

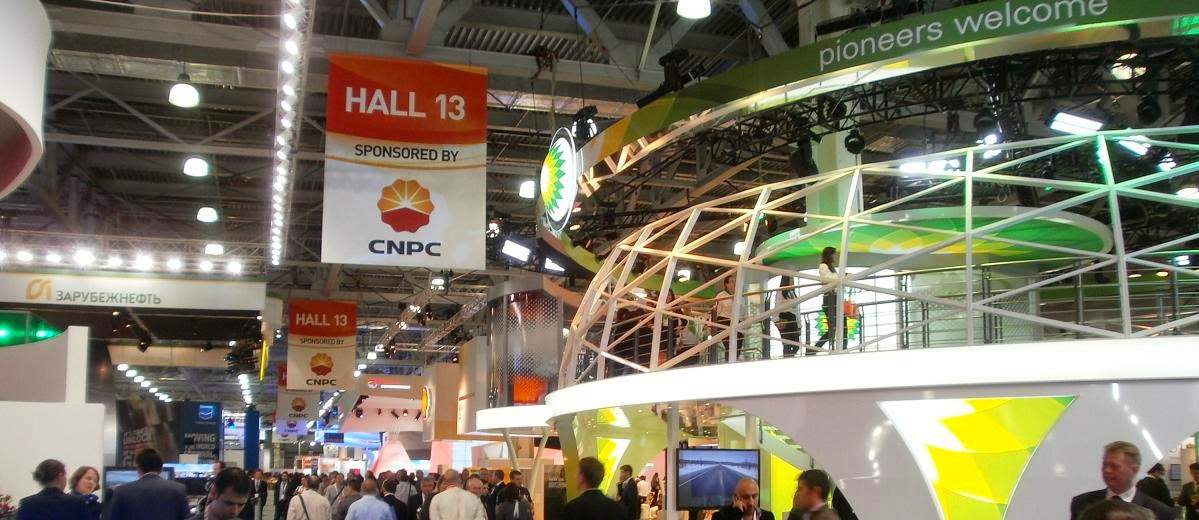

© Gaurav Sharma 2015. Photo: Support ships in the Gulf of Mexico © BP