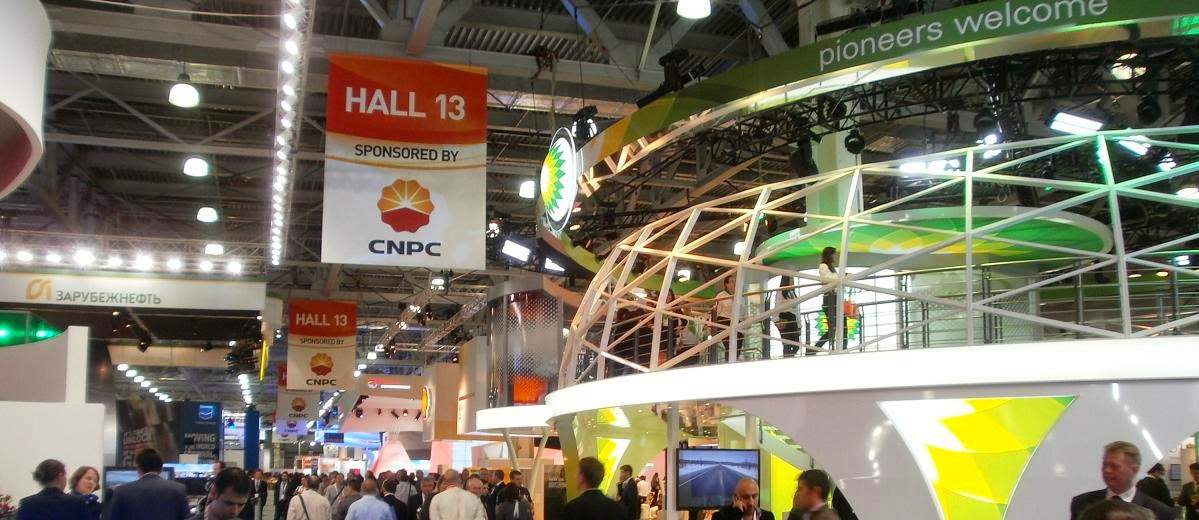

Since the initial flare-up in Iraq little over a fortnight ago, many commentators have been revising or tweaking their Brent price predictions and guidance for the remainder of 2014. The Oilholic won't be doing so for the moment, having monitored the situation, thought hard, gathered intelligence and discussed the issue at length with various observers at the last OPEC summit and 21st World Petroleum Congress earlier this month.

Based on intel and instinct, yours truly has decided to maintain his 2014 benchmark price assumptions made in January, i.e. a Brent price in the range of US$90 to $105 and WTI price range of $85 to $105. Brent's premium to the WTI should in all likelihood come down and average around $5 barrel. Nonetheless, geopolitical premium might ensure an upper range price for Brent and somewhere in the modest middle for the WTI range come the end of the year.

Why? For starters, all the news coming from Iraq seems to indicate that fears about the structural integrity of the country have eased. While much needed inward investment into Iraq's oil & gas industry will take a hit, majority of the oil production sites are not under ISIS control.

In fact, Oil Minister Abdul Kareem al-Luaibi recently claimed that Iraq's crude exports will increase next month. You can treat that claim with much deserved scepticism, but if anything, production levels aren't materially lower either, according to anecdotal evidence gathered from shipping agents in Southern Iraq.

The situation is in a flux, and who has the upper hand might change on a daily basis, but that the Iraqi Army has finally responded is reducing market fears. Additionally, the need to keep calm is bolstered by some of the supply-side positivity. For instance, of the two major crude oil consumers – US and China – the former is importing less and less crude oil from the Middle East, thereby easing pressure by the tanker load. Had this not been the case, we'd be in $120-plus territory by now, according to more than one City trader.

Some of the market revisions to oil price assumptions, while classified as 'revisions' have been pragmatic enough to reflect this. Many commentators have merely gone to the upper end of their previous forecasts, something which is entirely understandable.

For instance, Moody's increased the Brent crude price assumptions it uses for rating purposes to $105 per barrel for the remainder of 2014 and $95 in 2015. In case of the WTI, the ratings agency increased its price assumptions to $100 per barrel for the rest of 2014, and to $90 in 2015. Both assumptions are within the Oilholic's range, although they represent $10 per barrel increases from Moody's previous assumptions for both WTI and Brent in 2014 and a $5 increase for 2015.

"The new set of price assumptions reflects the agency's sense of firm demand for crude, even as supplies increase as a response to historically high prices. New violence in Iraq coupled with political turmoil in that general region in mid-2014 have led to supply constraints in the Middle East and North Africa," Moody's said.

But while these constraints exist, Moody's echoed vibes the Oilholic caught on at OPEC that Saudi Arabia, which can affect world global prices by adjusting its own production levels, has appeared unwilling to let Brent prices rise much above $110 per barrel on a sustained basis.

Away from pricing matters to some ratings matters with a few noteworthy notes – first off, Moody's has upgraded Schlumberger's issuer rating and the senior unsecured ratings of its guaranteed subsidiaries to Aa3 from A1.

Pete Speer, Senior Vice-President at the agency, said, "Schlumberger's industry leading technologies and dominant market position coupled with its conservative financial policies support the higher Aa3 rating through oilfield services cycles. The company's growing asset base and free cash flow generation also compares well to Aa3-rated peers in other industries."

Meanwhile, Fitch Ratings says the Iraqi situation does not pose an immediate threat to the ratings of its rated Western investment-grade oil companies. However, the agency reckons if conflict spreads and the market begins to doubt whether Iraq can increase its output in line with forecasts there could be a sharp rise in world oil prices because Iraqi oil production expansion is a major contributor to the long-term growth in global oil output.

The conflict is closest to Iraqi Kurdistan, where many Western companies including Afren (rated B+/Stable by Fitch) have production. However, due to ongoing disagreements between Baghdad and the Kurdish regional government, legal hurdles to export of Iraqi crude remain, and therefore production is a fraction of the potential output.

Other companies, such as Lukoil (rated BBB/Negative by Fitch), operate in the southeast near Basra, which is far from the areas of conflict and considered less volatile.

Alex Griffiths, Head of Natural Resources and Commodities at Fitch Ratings, said, "Even if the conflict were to spread throughout Iraq and disrupt other regions, the direct loss of revenues would not affect major investment-grade rated oil companies because Iraqi output is a very small component of their global production."

"In comparison, disruption of gas production in Egypt and oil production in Libya during the "Arab Spring" were potential rating drivers for BG Energy Holdings (A-/Stable) and Eni (A+/Negative), respectively," he added.

On a closing note, here is the Oilholic's latest Forbes article discussing natural gas pricing disparities around the world, and why abundance won't necessarily mitigate this. That's all for the moment folks. Keep reading, keep it 'crude'!

To follow The Oilholic on Twitter click here.

To follow The Oilholic on Google+ click here.

To follow The Oilholic on Forbes click here.

To email: gaurav.sharma@oilholicssynonymous.com

To follow The Oilholic on Google+ click here.

To follow The Oilholic on Forbes click here.

To email: gaurav.sharma@oilholicssynonymous.com

© Gaurav Sharma 2014. Photo: Oil drilling site © Shell photo archives